I know I'm too late on this one. BD2 blew me up on the text and I thought back to seeing my boy Leslie's picture in the paper. I just figured it was an article about how he was still relevant and funny or how he managed to resurrect his career again at 80 something. This dude had so many awesome lines and general hilariousness, but no one has uploaded them to YouTube yet. So here's a generic 8 minute long Airplane/Naked Gun tribute. Not all Leslie, unfortunately, you got to weed through it. RIP, Jackal. BMR will keep quotin' that ass.

Wednesday, December 1, 2010

Concept of the Day: Context

BHMF linked to this post by aspiring chemist Benjamin Lee as a rebuttal to BMR's post on Paul Krugman. So let's take a look at Mr. Lee's argument, shall we?

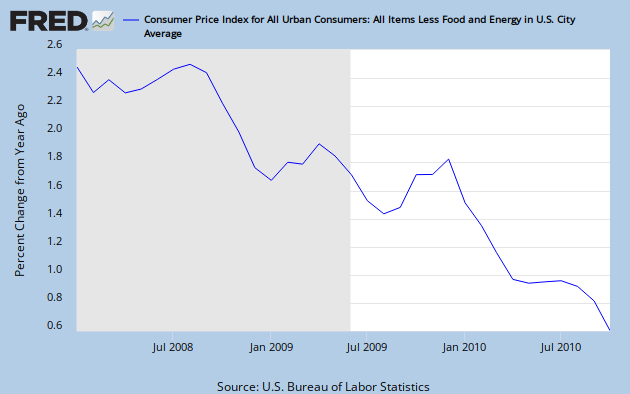

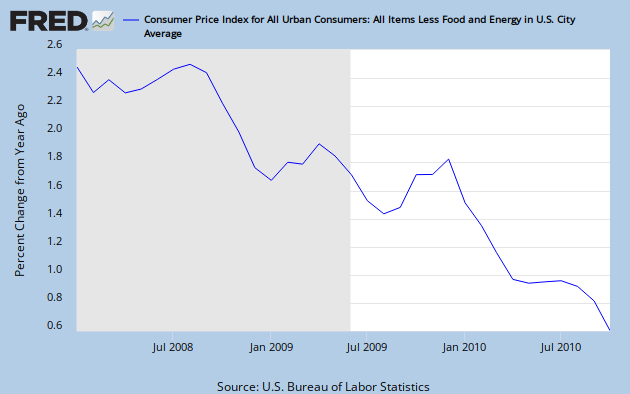

He begins by mocking Dr. Krugman's "so-called deflationary spiral", pointing out that we've had "six straight months of price increases". In other words, deflation can't be a potential problem, obviously, because it's been half a year (six whole months) since inflation was less than or equal to zero. So why does Dr. Krugman fear deflation? To the data...

So inflation has been trending downward ever since the economic crisis started. And the last point on the graph above (from October) represents "the smallest 12-month increase in the history of the index, which dates to 1957." Wow, our "Nobel Prize-winning economist" (scare quotes from Mr. Lee) sure hasn't been paying attention, huh?

So inflation has been trending downward ever since the economic crisis started. And the last point on the graph above (from October) represents "the smallest 12-month increase in the history of the index, which dates to 1957." Wow, our "Nobel Prize-winning economist" (scare quotes from Mr. Lee) sure hasn't been paying attention, huh?

But on to our main theme: Context. Mr. Lee goes on to make the argument that Dr. Krugman was correct in deeming deficits a problem during the Bush years but contradicting himself now by saying deficits are part of the solution to the economic downturn.

But he ignores that the situations surrounding those deficits were completely different! President Bush and the Republicans in Congress rolled up huge deficits while the economy was growing and, as a result, federal revenues were rapidly increasing. It's not really any secret how:

Compare that to Obama, who passed the stimulus (the goal of which was deficit spending) and....well, that's about it, actually. (The Affordable Care Act was completely paid for via spending cuts and tax increases.) The increase in the deficit under Obama is almost entirely because of the shitty economy (people who don't have jobs don't pay taxes, reducing revenue, while often requiring safety net services, which costs money).

Compare that to Obama, who passed the stimulus (the goal of which was deficit spending) and....well, that's about it, actually. (The Affordable Care Act was completely paid for via spending cuts and tax increases.) The increase in the deficit under Obama is almost entirely because of the shitty economy (people who don't have jobs don't pay taxes, reducing revenue, while often requiring safety net services, which costs money).

Basically, my understanding of Krugman's view of the 2008 economic slump is that the financial crisis triggered a panic, in which everyone suddenly said "Holy shit, my savings are gone, my house is under water, I might lose my job....I need to save every penny I can right now!" But everyone can't suddenly start saving at once without the money coming from somewhere. The result is that the economy to steadily contracts as less and less money is flowing around. [Imagine a two person economy where every day I sell you something for $10 and you in turn sell me something back, also for $10. Every day we each earn $10 while also getting $10 worth of goods. But if we each suddenly decide to save 10 cents each day, on day 2 we're each only making $9.90 and by day 50 the economy stops altogether.] This is especially bad, because the contraction leads to reduced growth expectations, which lowers interest rates, which decreases the incentive for people to invest their money rather than stuff it under their mattress (and if inflation turns to deflation, suddenly people make money by holding cash, and the whole economic engine starts functioning backwards).

So the solution is have someone put money into the economy so that the savings shock doesn't cause massive contraction (and mainly widespread, long-term unemployment that can ruin people's lives and, if it lasts too long, limit the growth potential of the economy in the future), in one of two ways:

Moreover, Mr. Lee never acknowledges that while Dr. Krugman advocates further deficit-financed fiscal stimulus (as does Chairman Bernanke, a Republican originally appointed by Bush), he has always made it clear that America needs to make serious strides to address our longer-term debt issues. And that has to start with reforms to Medicare and how America does health care more broadly. But the GOP has said that's evil, too.

As Mr. Lee notes, "in 2003, [D]r. Krugman wrote a great article with an incredibly accurate picture of the financial health of the United States at the time." Perhaps Mr. Lee should consider whether Dr. Krugman, so prescient seven years ago, might also know what he's talking about this time around.

As Mr. Lee notes, "in 2003, [D]r. Krugman wrote a great article with an incredibly accurate picture of the financial health of the United States at the time." Perhaps Mr. Lee should consider whether Dr. Krugman, so prescient seven years ago, might also know what he's talking about this time around.

He begins by mocking Dr. Krugman's "so-called deflationary spiral", pointing out that we've had "six straight months of price increases". In other words, deflation can't be a potential problem, obviously, because it's been half a year (six whole months) since inflation was less than or equal to zero. So why does Dr. Krugman fear deflation? To the data...

So inflation has been trending downward ever since the economic crisis started. And the last point on the graph above (from October) represents "the smallest 12-month increase in the history of the index, which dates to 1957." Wow, our "Nobel Prize-winning economist" (scare quotes from Mr. Lee) sure hasn't been paying attention, huh?

So inflation has been trending downward ever since the economic crisis started. And the last point on the graph above (from October) represents "the smallest 12-month increase in the history of the index, which dates to 1957." Wow, our "Nobel Prize-winning economist" (scare quotes from Mr. Lee) sure hasn't been paying attention, huh?But on to our main theme: Context. Mr. Lee goes on to make the argument that Dr. Krugman was correct in deeming deficits a problem during the Bush years but contradicting himself now by saying deficits are part of the solution to the economic downturn.

But he ignores that the situations surrounding those deficits were completely different! President Bush and the Republicans in Congress rolled up huge deficits while the economy was growing and, as a result, federal revenues were rapidly increasing. It's not really any secret how:

- He passed two massive ($4 Trillion) tax cut packages...and cut no spending to offset them.

- He started wars in Afghanistan and Iraq (to the tune of $1 Trillion)...and did not raise taxes or cut spending to offset them.

- He passed a massive ($400 Billion) Medicare prescription drug benefit...and put it entirely on the deficit.

Compare that to Obama, who passed the stimulus (the goal of which was deficit spending) and....well, that's about it, actually. (The Affordable Care Act was completely paid for via spending cuts and tax increases.) The increase in the deficit under Obama is almost entirely because of the shitty economy (people who don't have jobs don't pay taxes, reducing revenue, while often requiring safety net services, which costs money).

Compare that to Obama, who passed the stimulus (the goal of which was deficit spending) and....well, that's about it, actually. (The Affordable Care Act was completely paid for via spending cuts and tax increases.) The increase in the deficit under Obama is almost entirely because of the shitty economy (people who don't have jobs don't pay taxes, reducing revenue, while often requiring safety net services, which costs money).Basically, my understanding of Krugman's view of the 2008 economic slump is that the financial crisis triggered a panic, in which everyone suddenly said "Holy shit, my savings are gone, my house is under water, I might lose my job....I need to save every penny I can right now!" But everyone can't suddenly start saving at once without the money coming from somewhere. The result is that the economy to steadily contracts as less and less money is flowing around. [Imagine a two person economy where every day I sell you something for $10 and you in turn sell me something back, also for $10. Every day we each earn $10 while also getting $10 worth of goods. But if we each suddenly decide to save 10 cents each day, on day 2 we're each only making $9.90 and by day 50 the economy stops altogether.] This is especially bad, because the contraction leads to reduced growth expectations, which lowers interest rates, which decreases the incentive for people to invest their money rather than stuff it under their mattress (and if inflation turns to deflation, suddenly people make money by holding cash, and the whole economic engine starts functioning backwards).

So the solution is have someone put money into the economy so that the savings shock doesn't cause massive contraction (and mainly widespread, long-term unemployment that can ruin people's lives and, if it lasts too long, limit the growth potential of the economy in the future), in one of two ways:

- The federal government can run a big deficit during the shock. After all, if the federal government, the largest consumer in the economy, joins in the savings frenzy by cutting spending, it only increases the contraction.

- The Fed can basically create money during the shock (so in the example above, when everyone takes their 10 cents, there's still $10 moving around). This will reduce the value of the currency to some extent (what the Fed is doing is not huge), but that's not really a bad thing, since it decreases the incentive for destructive (i.e. mattress) savings.

Moreover, Mr. Lee never acknowledges that while Dr. Krugman advocates further deficit-financed fiscal stimulus (as does Chairman Bernanke, a Republican originally appointed by Bush), he has always made it clear that America needs to make serious strides to address our longer-term debt issues. And that has to start with reforms to Medicare and how America does health care more broadly. But the GOP has said that's evil, too.

As Mr. Lee notes, "in 2003, [D]r. Krugman wrote a great article with an incredibly accurate picture of the financial health of the United States at the time." Perhaps Mr. Lee should consider whether Dr. Krugman, so prescient seven years ago, might also know what he's talking about this time around.

As Mr. Lee notes, "in 2003, [D]r. Krugman wrote a great article with an incredibly accurate picture of the financial health of the United States at the time." Perhaps Mr. Lee should consider whether Dr. Krugman, so prescient seven years ago, might also know what he's talking about this time around.

Boogerdamus Speak Da Troof: ETs

It's your ol' pal Boogers up to his same ol' tricks, exposing X-files shit like Brett Favre dick pics. Your boy requested a press pass and has a question drafted to boot. Ba leeve that.

Subscribe to:

Comments (Atom)