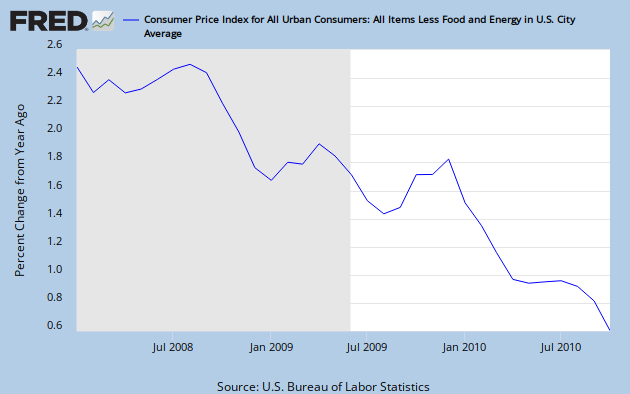

He begins by mocking Dr. Krugman's "so-called deflationary spiral", pointing out that we've had "six straight months of price increases". In other words, deflation can't be a potential problem, obviously, because it's been half a year (six whole months) since inflation was less than or equal to zero. So why does Dr. Krugman fear deflation? To the data...

So inflation has been trending downward ever since the economic crisis started. And the last point on the graph above (from October) represents "the smallest 12-month increase in the history of the index, which dates to 1957." Wow, our "Nobel Prize-winning economist" (scare quotes from Mr. Lee) sure hasn't been paying attention, huh?

So inflation has been trending downward ever since the economic crisis started. And the last point on the graph above (from October) represents "the smallest 12-month increase in the history of the index, which dates to 1957." Wow, our "Nobel Prize-winning economist" (scare quotes from Mr. Lee) sure hasn't been paying attention, huh?But on to our main theme: Context. Mr. Lee goes on to make the argument that Dr. Krugman was correct in deeming deficits a problem during the Bush years but contradicting himself now by saying deficits are part of the solution to the economic downturn.

But he ignores that the situations surrounding those deficits were completely different! President Bush and the Republicans in Congress rolled up huge deficits while the economy was growing and, as a result, federal revenues were rapidly increasing. It's not really any secret how:

- He passed two massive ($4 Trillion) tax cut packages...and cut no spending to offset them.

- He started wars in Afghanistan and Iraq (to the tune of $1 Trillion)...and did not raise taxes or cut spending to offset them.

- He passed a massive ($400 Billion) Medicare prescription drug benefit...and put it entirely on the deficit.

Compare that to Obama, who passed the stimulus (the goal of which was deficit spending) and....well, that's about it, actually. (The Affordable Care Act was completely paid for via spending cuts and tax increases.) The increase in the deficit under Obama is almost entirely because of the shitty economy (people who don't have jobs don't pay taxes, reducing revenue, while often requiring safety net services, which costs money).

Compare that to Obama, who passed the stimulus (the goal of which was deficit spending) and....well, that's about it, actually. (The Affordable Care Act was completely paid for via spending cuts and tax increases.) The increase in the deficit under Obama is almost entirely because of the shitty economy (people who don't have jobs don't pay taxes, reducing revenue, while often requiring safety net services, which costs money).Basically, my understanding of Krugman's view of the 2008 economic slump is that the financial crisis triggered a panic, in which everyone suddenly said "Holy shit, my savings are gone, my house is under water, I might lose my job....I need to save every penny I can right now!" But everyone can't suddenly start saving at once without the money coming from somewhere. The result is that the economy to steadily contracts as less and less money is flowing around. [Imagine a two person economy where every day I sell you something for $10 and you in turn sell me something back, also for $10. Every day we each earn $10 while also getting $10 worth of goods. But if we each suddenly decide to save 10 cents each day, on day 2 we're each only making $9.90 and by day 50 the economy stops altogether.] This is especially bad, because the contraction leads to reduced growth expectations, which lowers interest rates, which decreases the incentive for people to invest their money rather than stuff it under their mattress (and if inflation turns to deflation, suddenly people make money by holding cash, and the whole economic engine starts functioning backwards).

So the solution is have someone put money into the economy so that the savings shock doesn't cause massive contraction (and mainly widespread, long-term unemployment that can ruin people's lives and, if it lasts too long, limit the growth potential of the economy in the future), in one of two ways:

- The federal government can run a big deficit during the shock. After all, if the federal government, the largest consumer in the economy, joins in the savings frenzy by cutting spending, it only increases the contraction.

- The Fed can basically create money during the shock (so in the example above, when everyone takes their 10 cents, there's still $10 moving around). This will reduce the value of the currency to some extent (what the Fed is doing is not huge), but that's not really a bad thing, since it decreases the incentive for destructive (i.e. mattress) savings.

Moreover, Mr. Lee never acknowledges that while Dr. Krugman advocates further deficit-financed fiscal stimulus (as does Chairman Bernanke, a Republican originally appointed by Bush), he has always made it clear that America needs to make serious strides to address our longer-term debt issues. And that has to start with reforms to Medicare and how America does health care more broadly. But the GOP has said that's evil, too.

As Mr. Lee notes, "in 2003, [D]r. Krugman wrote a great article with an incredibly accurate picture of the financial health of the United States at the time." Perhaps Mr. Lee should consider whether Dr. Krugman, so prescient seven years ago, might also know what he's talking about this time around.

As Mr. Lee notes, "in 2003, [D]r. Krugman wrote a great article with an incredibly accurate picture of the financial health of the United States at the time." Perhaps Mr. Lee should consider whether Dr. Krugman, so prescient seven years ago, might also know what he's talking about this time around.

My bachelors of econimcs from a top 25 public university slow claps in your general direction sir. We clearly do not call you head because you suck a mean cock.

ReplyDeleteI feel like I did that time I picked a fight with a dude twice my size only to have T-Large step in and handle my business.

ReplyDeleteWhat Head said, BHMF. SS, you studied economics? Why?

Because economics is easy but seems like its hard. Do you understand supply and demand? Yeah that's pretty much it with different extrapolations and inferences drawn from that one basic concept and law of life. If people want shit they will give something up to get it. The more they want it (or the more people that want it) the more you can get from them if you have it. That's pretty much it. You just graduated, congratulations!

ReplyDeleteWell hang on. I like titties. Hot bitches have them. What do I have to give hot bitches to get me some titties? A hot bitch walks into a bar at 1:07am, I leave my crib at 1:09am. How long do I get awesome until that hot bitch gives me some titties? Tico, feel free to jump in at any time.

ReplyDeleteWould anyone care for some doom and gloom? BHMF, Head, fight!

ReplyDeleteThat Youtube is amazing. But that article is seriously retarded. I love the "OMG Deficits are SOOOO Huge, we must cut entitlements NOW!" arguments. And by "love" I mean "want to fucking burn".

ReplyDeleteYes, deficits are huge. But they are going to be huge no matter what in the middle of a recession as massive as this one. The only thing, other than the big reduction in the tax base due to the recession, that has changed since 2000 (or fuck, since 1970) is that Republicans have cut taxes cut taxes cut taxes, mostly on the rich.

So if these people are seriously concerned about the budget deficits, they should be advocating (1) reducing growth in health care costs and (2) raising taxes, particularly on the rich (or via a carbon tax). But they're not making that argument. Why? Probably because they're rich and don't want their taxes raised and couldn't give a fuck if a bunch of old people are dead or destitute because they cut Social Security or Medicare.

When you flip a switch and something stops working, isn't the first solution to fixing it usually to flip the switch back to where it was in the first place? Apparently not for these people. We had the big experiment in Republican budget management, from 1980 to 2008. It fucking failed. It's time to move on.

It sounds like we're going to continue to get bent over until we get all Bolshevik/Menshevik on their ass. Is that your contention, representative from bumfuck Blacksburg?

ReplyDeleteJon Stewart had a great quote Monday night about Wikileaks/War on Terror, in case you missed it:

"It's like we're the commission -less middlemen in a war we're waging on ourselves. "

"What do I have to give hot bitches to get me some titties?"

ReplyDeleteMoney dumbass.

It really honestly blows my mind that people can't understand a simple economic principle such as "taxes are the governments income". Cutting taxes is like our country taking a pay cut.

ReplyDeleteCan you quit your consulting job and go work a more fun job at a bowling alley and buy a new car? Sure you can if you want to take on a bunch of credit card debt and fuck your life up miserably in ways you won't recover from for 20 years...

That's what our country did from 2000-2008. It worked at a bowling alley and bought a new house and car and a bunch of bling. America is ghetto fabulous. Hood rich. You don't get over 8 years of dumbass living in one year unless you're slinging that yayo... and we don't own the worlds yayo, we're just addicted to it.

One more thought: You want to know what it looks like to try to get out of this economic slump by having government cut back, too? See Ireland, where they tried it and things aren't working out so hot.

ReplyDeleteWell they sure as hell aren't gonna stop drinking, so back to the drawing board, I guess.

ReplyDeleteOkay BMR, this thing is on. But its gonna have to wait till I get home. Besides big words and lots of data and graphs don't scare me. And before I begin, how long did this damn thing take you Head???

ReplyDeleteOkay can't leave ya hangin BMR, just a little teaser...........and I quote

"And yes, both of those options increase inflation expectations, but that is absolutely a good thing given the state of the economy right now (see the discussion of current inflation and the problems with deflation, above).

Moreover, Mr. Lee never acknowledges that while Dr. Krugman advocates further deficit-financed fiscal stimulus (as does Chairman Bernanke, a Republican originally appointed by Bush), he has always made it clear that America needs to make serious strides to address our longer-term debt issues."

And so if I understand this correctly what you are saying is we increase the risk of inflation/HYPER-inflation (ever heard of that?{scare tactic I suppose}[BMR when you hear HYPER in front of inflation just think atom bomb on the economy]) which will be a good thing for the present but is frowned upon in the long term? Okay sounds like 'ol Krugman and THE FED want to have their cake and eat it too........well I got some news for them............

Your ellipses are too long? Seriously though, I baited you and Head into an economic-off. It's cool. It's why we have the Den. Furthermore, it's abundantly clear BHMF takes this shit more serious than all of us, dude picked up and moved to Alaska(KFTC.). That makes Blacksburg look like Times Square.

ReplyDeleteOkay, agreed, hyperinflation is bad. So I guess you'll be arguing that there is no inflation between 0.6% and 6.5 quindecillion novemdecillion percent. Good luck with that; try not to quote a chemist this time!

ReplyDeleteP.S. It took me most of the morning - I write slow and was actually looking to include even more graphs before I got tired.

P.P.S. Seth Greenberg, I'm still waiting to see shots on those last two possessions. (In case you weren't watching, they went (1) Tipped pass, Purdue timeout before the tie up and (2) Kicked ball, tie up, Purdue ball.)

Seth Greenberg reminds me of a young and lean Don Rickles.

ReplyDeleteOkay I'm working here..........but before I get started I meant to say previously that one Mr Scar Shoulders summed up the whole field of economics rather succinctly in the third post above. I couldn't have said it better myself.

ReplyDeleteOh and yes BMR bait on, I have been training for this economic-off ( my ellipses are too long? { what the fuck is an economic-off??? } ) my whole life. Times Square beware. Head you still live in bum-fuck Blacksburg??? Isn't that in the middle of backwards ass redneck SW VA??? I know that neck of the woods too..........

Okay here is my rebuttal, I envisioned great things for it, but now that I have tossed back a few drinks I shall scale it down (a bit) and try and keep it short and sweet.

ReplyDeleteTo begin with, lets look at the big picture (six MEASLY months is just not enough) and maybe we can get a better grasp on things. Now this is just a little tool that might help you appreciate the effects a central bank will have on a economy in the long term. Now this "little tool" I speak of is an inflation calculator and according to my numbers ($20 starting in 1913 {the year the current FEDERAL RESERVE was covertly created} and 2009) we have experienced a quite significant inflation in the value of a dollar. Now feel free to enter your own numbers and get a feel for how badly our ONE PARTY GOVT is screwing us! Now these numbers might not be exact, but I reckon that they are close enough for our purposes. You may now begin to ask yourself who we have to thank for this blatant devaluing of our very livelihoods. The answer I assure you is our Central Bank (the Federal Reserve), our government (Republican or Democrat), and our Media (the enablers of our government), just to name a few.

So to put things in context: it would be hard to deny that the NY Times and Paul Krugman are NOT one of the most vocal CHEERLEADERS of our respected ELECTED representatives. This can only lead me to conclude that, "NO, Paul Krugman has ABSOLUTELY no clue what he is talking about this time around."

I will allow each Jackal to draw his or her own conclusion from here. And to sum up, I must point out that Head's statement, "Okay, agreed, hyperinflation is bad." might just be one of the most apparent UNDER-statements in recent memory.

And since Head insists that I NOT quote a lowly chemist this time around, I instead choose a physicist ( known for his work in the path integral formulation of quantum mechanics, the theory of quantum electrodynamics and the physics of the superfluidity ) who is no stranger to Nobel Prizes himself and who is also widely considered to be an intellectual equal to such great thinkers as Galileo, Newton, and Einstein.

This comment has been removed by the author.

ReplyDeleteIt seems like you're conflating two very different things: the dollar vs. "our very livelihoods". To be succinct about it, capitalism does, yes, lead to a slow deterioration in the value of a given unit of currency. But at the same time, it also leads to an increase in purchasing power in terms of real goods over time. For example, in the period you cite (1913 to today), the average U.S. household's ability to pay for goods and services increased more than threefold (from 15,000 to more than 50,000 2006 dollars), and that's already accounting for the fact that $10 then is equivalent to $214 now. Simply, income outpaced inflation. You can quibble with the data in some ways - for example, I don't particularly care about the average household so much as the median - but it still is backed up by the reality that we see all around us - pretty much everyone in the U.S. today lives a lot better than our 1913 predecessors did.

ReplyDeleteAs for "it would be hard to deny that the NY Times and Paul Krugman are NOT one of the most vocal CHEERLEADERS of our respected ELECTED representatives." Suffice to say, Dr. Krugman has been very vociferous in his criticism of both the current President and the previous one. So I guess in a lot of ways I would deny it, unless I misunderstand your meaning.

I get that Feynman may not have seen the value in awards - he was a pretty eccentric and kind of awesome guy - but I don't find it undermining to the credibility of the Nobel that they gave one of their awards to "an intellectual equal to such great thinkers as Galileo, Newton, and Einstein."

Oh, and yes, I still live in Blacksburg. Well, sort of still - I moved away in May 2004 but moved back last August. And yep, it's in pretty remote SWVA! If you are ever in the area, we can guzzle liquor and argue about economics/politics by the campfire sometime. (I can't believe you're making me sound so establishment in this argument, by the way.)

ReplyDeletebhmf:Head

ReplyDeleteas

Rusty T. Bone:Boogers McRib

Haha. That graph( avg. income '13 - '06) is hilarious. The high points for American prosperity? War, oil embargoes and the dot com boom. Head, can you repurpose this material for a "KFTC" post? We need a shift in the way we think about carbon. That will be the key to sustaining the climb of that fleshy pink goodness in the graph. Either that, or we could move to Alaska and fish and climb glaciers(until they all melt) and shit.

ReplyDeleteHead, you're not the only Bernanke fan. No. 3 is a jackal ass sumbitch his damn self. Good countdown, hard to argue with No. 1, that's the dorkiest jackal I ever did see.

ReplyDelete"Last year's No. 1 FP Global Thinker might not have dreamed that 2010 could possibly be tougher than 2009. But even after the passage of historic financial regulatory reforms in July that gave the Fed unprecedented power, not to mention his work over the past two years steering the U.S. economy through its worst downturn since the Great Depression, Ben Bernanke still found himself taking shots from lawmakers and pundits alike. An upswing of populist anger, fury over politically difficult moves like the 2009 AIG bailout, and the interminable beat of bad job numbers have kept the Fed chairman in the foxhole.

ReplyDeleteBut he has not given up. This year, he has raised the Fed's balance sheet to a cool $2.3 trillion (from $850 billion before the crisis), shooting tens of billions of that over to the Treasury to help close the deficit, and pursued the controversial idea of quantitative easing, a high-powered stimulant. The morning after the Republican gains in the midterm elections suggested Congress would be gridlocked for years to come, he took the aggressive, risky step of announcing that the Fed would pump an additional $600 billion into the financial system by 2011, raising the bank's holdings to nearly $3 trillion and, ideally, lowering mortgage prices and the unemployment rate in a way the rest of the government may no longer have the tools to do. Although Bernanke recently admitted that "central bankers alone cannot solve the world's economic problems," his bold moves leave no doubt about who's in charge."

If that doesn't say "Go the fuck asleep, bhmf," I don't know what does.

Head's article and SS's economy break down are right on. EVERYONE should have 6 months worth of disposable income saved up and avoid any debt or purchasing goods (as their value will continue to go down).

ReplyDeleteIt was not Hoover's plan that got us out of the Great Depression it was WW2...No need to buy a gun or kftc, in Japan it just took 10 years.

Housing will continue to go down

Where the hell is Rusty T Bone anyhow? Seems about time he speak up and defend me from the mighty wrath of the establishment. Ahhh to hell with that lazy SOB!

ReplyDeleteHead--- I do not agree that, "capitalism does, yes, lead to a slow deterioration in the value of a given unit of currency." Now of course it can if we use FIAT money like we are today(or since NIXON changed it), but it doesn't necessarily need to be the case. And the statement, "but it still is backed up by the reality that we see all around us - pretty much everyone in the U.S. today lives a lot better than our 1913 predecessors did.", is something most people take for granted but I certainly do not buy into. In some aspects yes we most definitely live better but in others I am not so sure. The word better is much too objective. And of course it wasn't undermining giving it to Feynman when the damn award acutally meant something, but nowadays they give it to any hack they want to prop up and shine the spotlight on. Anyways, indeed the campfire and guzzling alcohol idea sounds mighty fine to me. I know a nice spot in VA, now we just need to find the time.

BMR---Where did you cut and paste that last post from? Anyways I am right there with ya. I agree the FED is large and charge. Big banks, and big oil rule the world. And I agree in the shift in the way we think about carbon, just not so sure a carbon tax will do anything except give more money and power to those large and in charge people.

I dunno..........don't have all the answers but if WW2 got us out of the Great Depression then it only follows that WW3 will get us out of the 2nd Great Depression. I don't think we will have to wait much longer. I hope I am wrong. No need to buy a gun(I would recommend buying two or three), just get your sticks and stones ready for a little known addendum to my man Albert's theory of relativity went something like this: "I know not with what weapons World War III will be fought, but World War IV will be fought with sticks and stones."

Yikes. My comment at 12:41pm was the text from my comment at 12:40pm, I was just amazed at the amount of DAP they were giving Bernanke, we only see figures of his, Barack's, fucking Bill Gates' in fiction. Present day heroes on a global scale. Regardless of personal beliefs, bhmf, who would you rather have in Bernanke's shoes and could they do more with what he was given? This is by far the most comments on one post. bhmf asked me about '17', we'd been there. We're in some Phosphorous-compatible shit here.

ReplyDeleteI guess a slow deterioration in the value of our currency doesn't really bother me. I'd be interested to know why you find it so objectionable.

ReplyDeleteI'd also be interested to know why you think, at least in some aspects, our lives are not preferable to those of our 1913 predecessors. I'm too lazy to go look up more statistics, but I would think, for example, that basic necessities, like food and running and hot water, are far more accessible and incidence of disease is much lower now than they were then. And that's before you get to more nebulous things like the awesomeness of the internet.

BMR, I'm pretty sure that way back in the advent of the Den, we had a post with something like 32 comments - I'm pretty sure it was a "JOTD: T-Large" one. However, I can't find it now - I'm think it might have been deleted in the Clonest Event in Den History. So perhaps this is the new winner...

ReplyDeleteSpeaking of which, Clonampieri got a promotion! He even kept up a blog for 42 days and it got four comments! Only one of which was by him!

And we fall short once more. The clones win again.

ReplyDelete